Adapting Modular Construction for the Future

The construction industry in the United States is facing numerous challenges, but modular building systems hold the potential to offer solutions. However, before we can fully embrace modular construction, the industry must undergo a significant transformation.

The advantages of modular construction in the US are crystal clear. The idea of manufacturing building components in factories and then assembling them on-site can tackle many of the pressing issues the construction sector currently faces, such as soaring material prices, disrupted supply chains, and a shortage of skilled labor.

Industrialized production methods provide a means to optimize material utilization, reducing waste in the process. The process of fitting modular components together on-site is not only faster but also requires less labor compared to traditional construction methods. According to McKinsey’s analysis, employing modular techniques could potentially cut end-to-end project timelines by 20 to 50 percent while reducing costs by up to 20 percent. Furthermore, modular projects are well-suited for urban job sites since they demand less space for material storage and preparation.

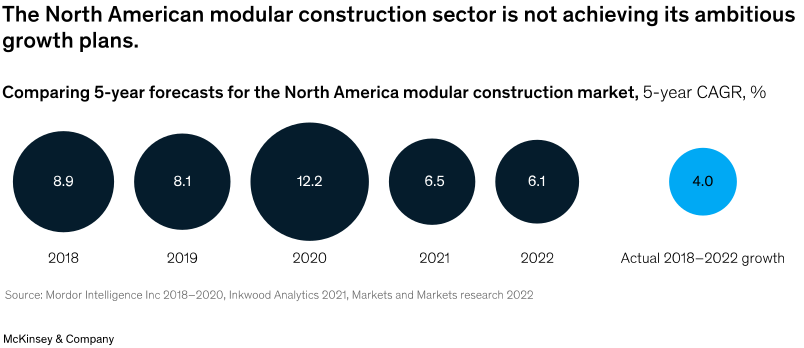

Despite these evident benefits, modular construction has not gained widespread acceptance in North America. In the US, less than 4 percent of current housing stock was constructed using modular techniques, while Japan stands at 15 percent, and Finland, Norway, and Sweden have reached an impressive 45 percent. Our examination of recent growth projections for North American modular construction companies paints a picture of only modest expansion, despite their ambitious growth plans.

It doesn’t stack up

So, why have modular construction companies failed to convince the US construction sector to adopt their methods more enthusiastically? We believe that a significant part of the challenge lies in the interactions between modular companies and the broader construction ecosystem.

The advantages of modular buildings stem from the industrialization of crucial construction tasks. Modular companies aim to standardize, streamline, and automate various elements of the value chain, transforming buildings into products rather than projects. To achieve this, modular players must possess top-tier manufacturing capabilities, including advanced digital design platforms and efficient production lines.

Consequently, modular construction firms often see themselves primarily as design and technology companies. This distinction is evident in how they present themselves to potential customers. The websites of modular companies typically showcase their production systems against a backdrop of computer screens and computer-aided design (CAD) renderings. In contrast, general contractors emphasize their track record in executing projects.

Nevertheless, it’s crucial to remember that modular construction remains a construction process. Every modular building system necessitates a developer ready to purchase it, a design that can accommodate it, a financial institution willing to back it, and a skilled on-site team capable of installing it. Each of these stakeholders must comprehend the requirements of modular systems and, importantly, share in the benefits of this approach.

Modular construction companies that disregard these essential ecosystem relationships can encounter issues that undermine their value proposition and even threaten their business’s viability. Let’s delve into some common problems and explore potential solutions.

Overdesign

Standardization empowers modular companies to employ efficient series production techniques. However, a design that is robust enough for every application will inevitably be over-engineered for most of them. For instance, in multistory buildings, the loads experienced by upper-story units are much lower than those at the base. Traditional construction methods require different specifications for different floors, whereas modular designs often adhere to a single specification optimized around the highest loads. This mismatch can inflate material costs and reduce the competitiveness of modular designs.

Companies can combat overdesign by employing design-to-value techniques to optimize features and material specifications for individual modules before manufacturing. This minimizes the excessive use of steel, wood, and concrete. One company managed to reduce its modules’ steel content by up to 30 percent during preproduction design reviews by having a skilled cost-engineering team design high-, medium-, and low-stress versions of the same product. This not only lowered the company’s raw material costs but also led to further reductions in manufacturing times, transportation requirements, and on-site assembly costs.

Addressing On-Site Challenges

In the United States, where modular construction systems are still relatively uncommon, the on-site contracting teams often lack familiarity with them. This unfamiliarity can undermine the advantages of modular systems. For instance, contractors who have built their careers on traditional concrete-in-wood formwork methods may allocate more time than necessary on a modular project due to their inexperience with these new components.

In the construction industry, delivering projects on time and within budget is a top priority. To ensure success, leading modular companies are taking proactive steps to enhance their project management capabilities. They are bringing in seasoned professionals from the construction industry to collaborate with contractors, oversee projects, and resolve issues on the ground. The insights and expertise of these professionals help refine products, streamline processes, and fine-tune commercial strategies.

Inefficiency issues can also arise, sometimes driven by a desire for higher profit margins. Modular systems excel in projects that involve repeatable and stackable designs, like identical apartments or dormitories. However, they face challenges when dealing with unique, custom designs preferred by developers in high-end projects. In an evolving market where multifamily residential customers increasingly seek some level of customization, leading modular companies face a choice. They can either maintain their focus on disciplined, repeatable projects to minimize vertical times and maximize profitability or leave finishing and customization to developers and customers.

Insufficient capital

Insufficient capital is a significant hurdle for modular construction, which is already a capital-intensive approach in an industry known for its capital demands. As modular systems lack an extensive track record, they are often perceived as high-risk compared to traditional construction methods. Consequently, modular firms must allocate additional working capital for performance bonds to provide security for building owners and mitigate perceived risks.

Traditional construction firms understand the paramount importance of cash flow. They excel at working capital management, with robust procurement functions and efficient processes for handling change orders. Modular players need to develop similar capabilities; operating like a construction company while incorporating technology aspects is not a sustainable long-term business model.

In the modular sector, there’s room for innovation in financial practices. Some modular construction companies collaborate with finance partners to devise a phased bonding approach. Under this arrangement, up to half of the project’s bond is released upon module manufacturing, with the remainder released upon project completion.

Unsteady manufacturing pipelines

Managing manufacturing pipelines is another challenge. Production lines operate most efficiently when there’s consistent demand and high utilization. However, the construction industry is inherently variable and unpredictable, creating a continuous challenge for modular companies. To maintain profitable production, some companies have taken on low-value contracts or bid for projects in regions where high logistics and on-site labor costs eat into margins.

To keep their factories busy with profitable work, modular players are adopting a more strategic, collaborative approach to business development. Leading companies employ advanced analytics tools to gain insights into construction costs in various regions. For example, the cost per square foot of concrete construction can be as much as 28 percent higher in California compared to Texas. Understanding local market conditions allows companies to focus their business development efforts in the most favorable regions.

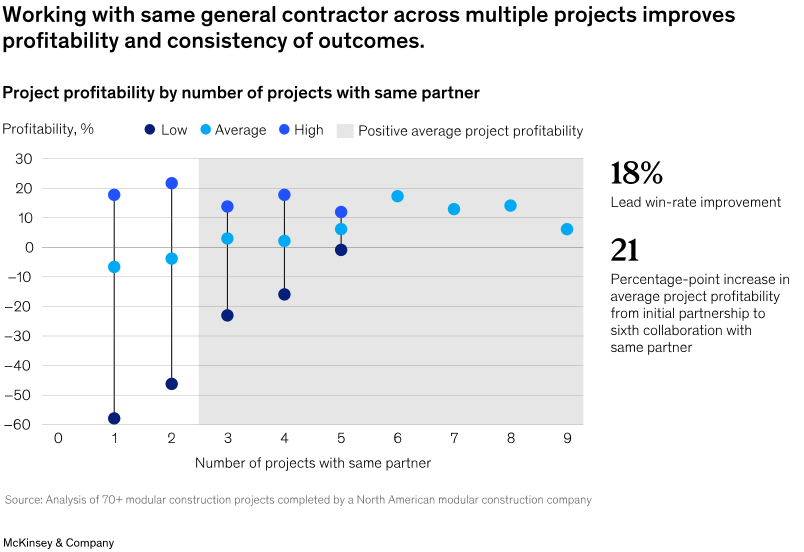

Furthermore, successful modular construction players work on building long-term strategic relationships with designers, developers, general contractors, and major customers. When there’s an existing partnership with a general contractor, modular firms can increase their bid-win rate by as much as 15 percent. A healthier pipeline of future work enables modular players to refine their products and enhance production capabilities. This strategic alignment between modular producers and at-scale developers is crucial for offsite construction to become a competitive industrialized alternative to traditional methods.

The Strength of Collaboration

Joining forces on multiple projects presents a wealth of advantages for all parties involved. For instance, early collaboration with designers ensures that building plans align perfectly with modular techniques. Our research also demonstrates that ongoing partnerships with general contractors down the line result in higher and consistently improved project margins (See Exhibit 2).

There’s also a growing call for modular players to share the financial gains from successful projects with their partners. A senior executive from a prominent US construction firm recently shared his perspective, saying, “General contractors have promised that modular construction is faster, of higher quality, and cost-effective. What we’ve observed is a reduction in costs, but not for everyone. The benefits aren’t necessarily reaching the building owners; they often end up with the modular component supplier.” To truly deliver on the promises of speed and cost efficiency, modular firms may need to work towards ensuring that all stakeholders, including owners, construction teams, and end-users, see the advantages. In an industry where thin profit margins have been the norm, this adaptability may play a pivotal role in nurturing enduring partnerships.

A Win-Win Scenario

Overcoming these challenges in modular construction could open the door to a new era of rapid growth. This would be beneficial not only for the modular sector itself but also for the wider construction industry and society at large, weary of delayed, over-budget infrastructure projects.

For developers and general contractors, modular systems offer the promise of quicker project completion, improved profit margins, and enhanced competitiveness, especially in regions and states where environmental concerns are paramount. Simultaneously, these very regions and states can leverage modular techniques to create more affordable housing in smaller, safer construction sites. Building this housing can also provide job opportunities for a more extensive range of skills compared to conventional projects.