Catalyzing Growth in Construction Technology: Strategies for Scaling AEC Innovation

To achieve significant growth in the field of construction technology, it’s imperative for founders, executives, and investors to address the challenges that hinder efficient expansion. Here’s how they can do just that.

When we look at construction sites in 2023, we may be surprised at how they resemble those from a century ago, with manual bricklaying, paper blueprints, and scaffold towers. The architecture, engineering, and construction (AEC) industry, worth a staggering $12 trillion, stands as one of the largest globally. However, it has been relatively slow in embracing digitization and innovation compared to other sectors.

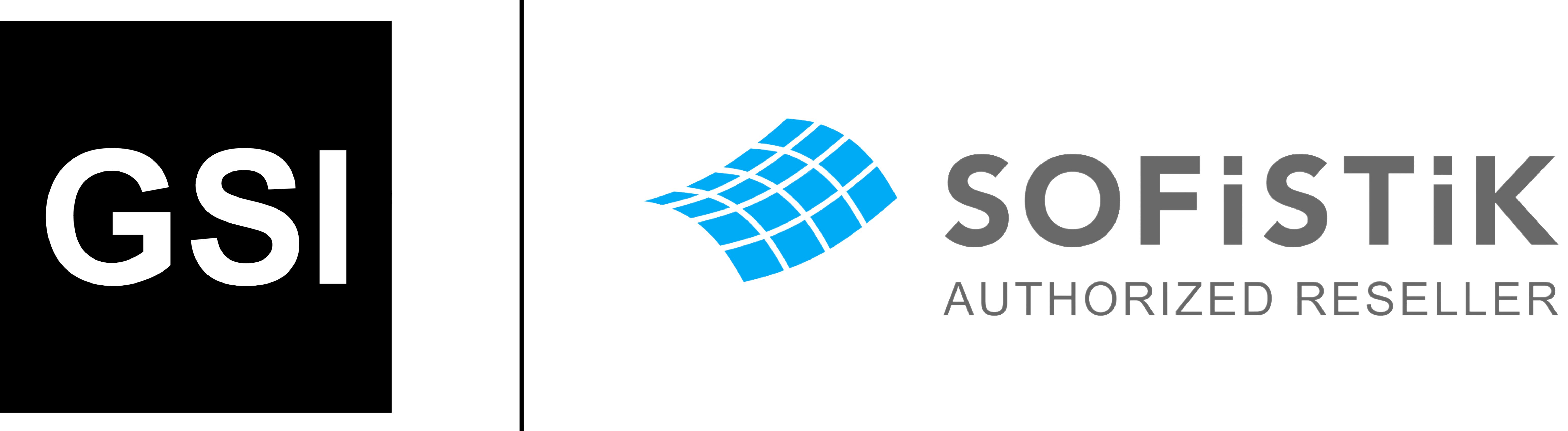

Nonetheless, the landscape is evolving rapidly. The growing demand for infrastructure, a shortage of skilled labor, and increasing demands for data transparency and integration from stakeholders are driving digital adoption at an unprecedented pace. As a result, the AEC tech ecosystem has witnessed a surge in investment and a wave of startups entering the scene. Between 2020 and 2022, an estimated $50 billion was invested in AEC tech, representing an 85 percent increase compared to the previous three years. During the same period, the number of deals in the industry grew by 30 percent, totaling 1,229 (see Figure 1).

While the AEC tech industry is maturing, it still lags behind more established software markets such as logistics, manufacturing, and agriculture in terms of scaling and sophistication. The industry has fewer scale-ups and unicorns considering its size. AEC tech companies face challenges in achieving efficient growth due to various factors among AEC customers, including fragmentation, relatively low IT expenditures (compared to other industries), and entrenched analog work processes.

In this context, the question arises: How can AEC tech companies accelerate adoption, boost sales, and achieve significant growth? To address this question, we conducted a survey of around 100 investors and AEC tech players in 2022. We also interviewed founders, investors, and prominent software companies within the industry. In addition, we conducted primary research and analyzed publicly available data on more than 3,000 AEC tech companies. This article presents the key findings of our research, highlighting investment trends that are propelling the digitization of the industry and offering strategies for tech businesses and their investors to overcome growth challenges.

1. Trends Accelerating the Digitization of AEC

The digitization of the AEC industry began gaining momentum a decade ago but has seen rapid acceleration in the last three years. Several trends indicate that this momentum will continue.

Economic Factors and Regulation as Drivers of Investment

A combination of supply and demand factors is fueling investment in AEC tech. On one hand, there is a strong global demand for long-term construction projects, driven in part by increased government stimulus measures, such as the $1.2 trillion Bipartisan Infrastructure Law in the United States and the €800 billion NextGenerationEU fund in Europe. Asset owners are also committing significant capital to decarbonize their portfolios, making them climate-resilient. On the other hand, there is a shortage of skilled workers due to retirements and transitions to other industries. In the United States, there are 440,000 job vacancies in AEC, compared to around 300,000 in 2019, and the United Kingdom has seen a near doubling of job vacancies since 2019. The industry is turning to digital technology to enhance productivity and bridge the gap between supply and demand.

Furthermore, regulatory changes are reinforcing this wave of digitization. For example, the United Kingdom’s Building Safety Act mandates a digital ledger of all building data for new residential buildings, while Sweden’s ID06 requires digital records of all construction workers on a site.

High Investor Optimism

Investment in AEC tech has witnessed substantial growth, and based on our research, more investors are recognizing the potential of AEC tech to transform the construction industry and create value at scale. This momentum is expected to continue, with 77 percent of survey respondents indicating their intention to invest in AEC tech at similar or higher levels in 2023. Additionally, 64 percent anticipate higher returns compared to other industry verticals.

Maturing Tech Scene

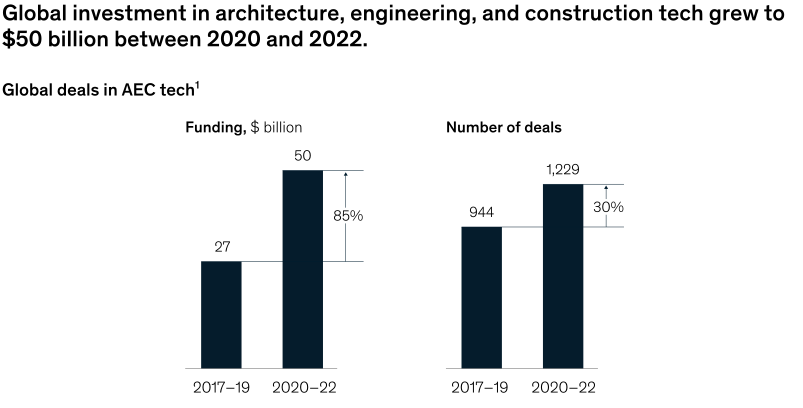

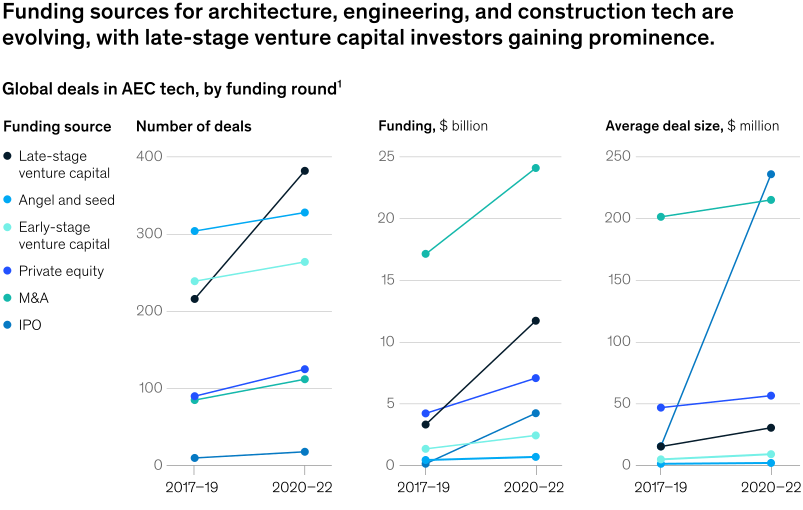

The proportion of late-stage venture capital in total AEC tech investment reached $11.5 billion between 2020 and 2022, more than triple that of the previous three years. Mergers and acquisitions (M&A) continue to be the primary source of funding for AEC tech ventures, accounting for 48 percent of all investments and 68 percent of all exits. The industry’s growth is further reflected in the doubling of the median deal size and post-money valuation since 2017.

Interoperability Demand

In 2020, we observed that AEC tech companies were targeting multiple use cases to address customer pain points. This trend continues, driven by customer demand for interoperability. Interoperability is achieved through virtual platforms built using open standards and workflows, such as openBIM, or through comprehensive one-stop-shop platforms developed by some of the largest AEC tech companies. Nearly half of the analyzed companies offer solutions that address three or more use cases.

AEC Tech and PropTech Convergence

Historically, AEC tech and property technology (proptech) evolved separately. AEC tech focused on the design and construction of assets, while proptech concentrated on the financing, planning, operation, and maintenance aspects of assets. However, this delineation is starting to blur as customers and technology players recognize the value of connecting these two ecosystems. Our analysis reveals that 20 percent of AEC tech companies address at least one proptech use case, such as linking the design and operation of building management systems using a digital twin.

2. Hurdles to Scaling AEC Tech Investments Remain

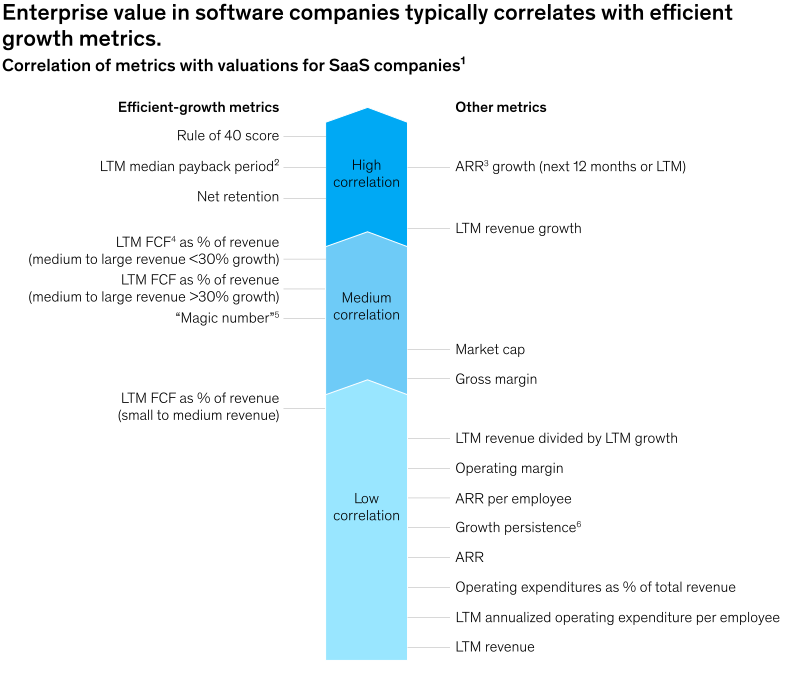

Despite the aforementioned trends, challenges persist in achieving efficient growth in the AEC tech industry. Our research across various industries demonstrates that as software companies expand, efficient growth increasingly correlates with valuations.

Within the AEC technology industry, our research indicates that efficient growth is particularly challenging for the following reasons:

- Customer Fragmentation: The average construction company employs fewer than ten people, and the average project involves over 100 different suppliers and subcontractors. Achieving scale necessitates selling to a large number of companies, making sales growth labor-intensive and slow. As one investor noted, “This is a risk-averse and fragmented sector at its core, so growth is slow, but it is extremely sticky.”

- Multiple Customer Personas: Founders often face difficulty in identifying the true customer because they lack a clear understanding of user versus buyer personas. Depending on the project, the customer could be the project manager, IT manager, or procurement manager. Moreover, purchase decisions are frequently made at the project level, not the enterprise level. Consequently, companies often need to resell the product for each new project, reducing net retention and increasing acquisition costs.

- Low Margins and Economic Headwinds: Convincing AEC companies to invest in software can be challenging, given the limited capacity for investment in an industry with low margins and economic headwinds, including inflation in materials costs. Additionally, the typical IT spend for AEC companies is 1 to 2 percent of revenue, compared to the industry average of 3 to 5 percent. Solutions must come with a compelling business case. While the return on investment can be high, companies have historically struggled to quantify the cost-saving benefits of their products.

- Adoption and Scaling Challenges: Encouraging tech adoption in a project-based industry like construction presents several challenges. Users often switch between different products for different projects, adapt to client preferences, and experience workforce turnover. Historically, the industry had limited digital capabilities, although this is changing as workers become more accustomed to using digital technology in their everyday work.

3. Strategies for Scaling AEC Tech Businesses

For companies that can surmount these challenges, there is a substantial opportunity to tap into a customer base larger than most other industries. Achieving this requires certain key growth characteristics, common to tech companies in AEC and other industries like manufacturing, travel, and logistics.

Pursue a Big Total Addressable Market and a Bold Vision

Investors and partners are more inclined to support founders with a grand vision for the industry, rather than those focused solely on niche problem-solving. A bold vision, effectively communicated to benefit users and the broader industry, attracts talent, investors, and customers and enables companies to move swiftly as they adjust their course toward a clear objective. For example, one AEC tech company concentrates on enhancing the predictability of project outcomes, thereby expanding its total addressable market beyond contractors and planners to encompass a broader customer base, including project owners, banks, and insurance companies.

A bold vision typically leads founders to contemplate the entire AEC tech ecosystem and explore ways to collaborate with other providers to create a seamless user experience and unlock additional value for a broader range of customers. For instance, one AEC design platform extended its core offering beyond architects and engineers to connect with product suppliers, allowing it to monetize transactions for building products used in designs.

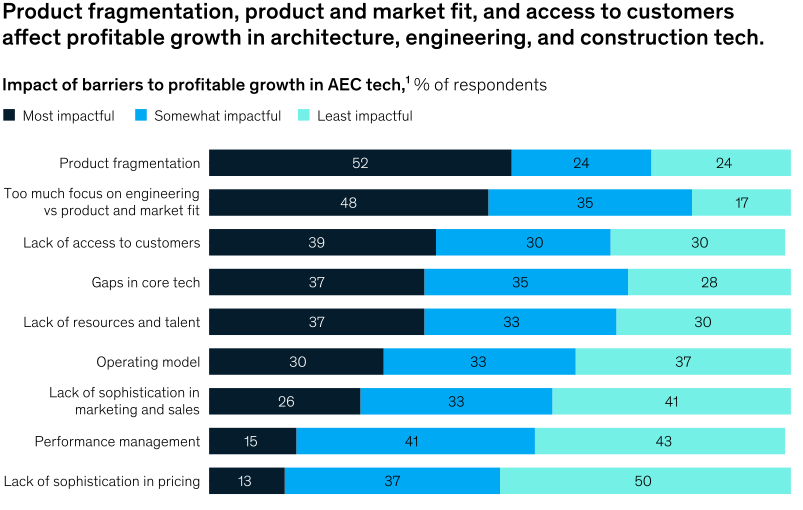

Achieve a Great Product-Market Fit

Finding the right product-market fit is crucial for investors across most industries, but AEC tech companies often struggle in this regard. Common issues, as indicated by our survey, include an overemphasis on engineering at the expense of product-market fit and product fragmentation.

As one AEC tech player explained, “Niche, technical design tools are often built by self-taught developers and construction professionals who built the tool to solve a specific problem or fill a gap in their workflow. As such, the very nature of those tools focuses on the tech and not the user experience.” In our discussions with startups and investors, three common themes emerged to help establish a better product-market fit, all of which require robust product management capabilities.

The first is focus. Given that customer needs vary across segments, companies would benefit from concentrating on one or a few specific segments, whether they are targeting architects, subcontractors, or distributors. As one founder put it, “I have potential customers in manufacturing, retail, construction, and facilities management across more than ten geographies, but we have to focus, or we will achieve nothing.”

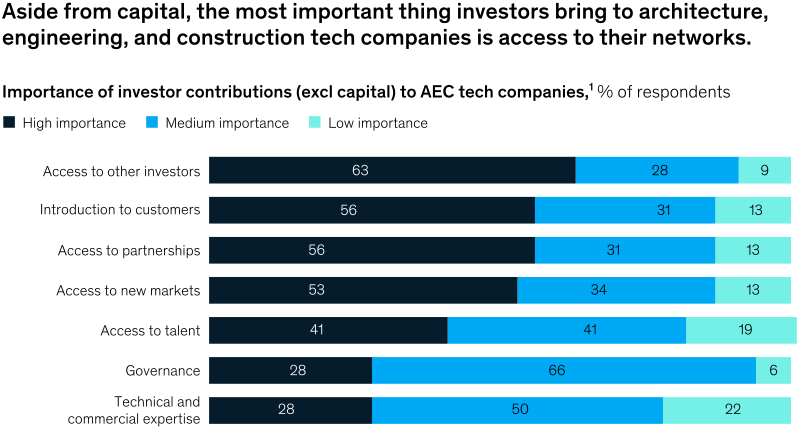

The second is feedback. Investors stressed the need for more founders with a balanced focus on both product and market and customer needs. Building a network of customers and collaborators can sharpen the market focus. Successful players often leverage their investors’ networks and beta customers, who receive early releases at a lower cost in exchange for testing and development feedback. This approach also grants access to a critical mass of other customers.

The third is flexibility. Virtually every startup and scale-up we spoke with reported significant changes to their product proposition in response to market feedback and evolving product-market fit. For example, one startup initially developed an app to measure material waste at construction sites but later adapted it to measure embodied carbon in materials.

Build a Customer Acquisition Engine with a Scalable Revenue and Distribution Model

Valuations for startups are closely tied to the annual recurring revenue (ARR) growth metric. In a fragmented market like AEC, customer acquisition is a challenging and costly endeavor. Based on our research, leading players differentiate themselves with three strategies to maximize the ARR return on marketing and research and development (R&D) investment:

- Deliver a Scalable Revenue Model: Some products require extensive customization, turning the software company into a consultancy. Successful businesses offer products that can be deployed with minimal customization and training, often favoring software over hardware. When customization or training is necessary, they invest time and resources primarily in high-potential customers, often partnering with independent software vendors to achieve scale.

- Find Creative Routes to Market: Breaking into the market one customer at a time is not a viable strategy. Successful players leverage their investors and existing customers to establish new market channels. They also work to lock in users early. For example, one design software provider distributed free copies of its software to architecture students, who then introduced it to their future employers. These players adopt a channel strategy aligned with customer tiers, including value-added resellers (VARs), distributors, low-cost remote channels (like multilingual remote inside-sales centers), self-serve platforms, web shops, and e-commerce.

- Empower the Sales Team: Successful software companies incentivize their direct-sales teams to cross-sell and upsell, fostering key account management capabilities. For instance, one leading player with multiple brands centralized its go-to-market strategy across brands to expedite cross-selling and upselling, while capping bonuses on some established products to drive sales of new products. The most effective sales organizations rely on data to discern the relationship between specific, often isolated, sales and marketing activities and overall growth outcomes.

Improve Net Retention with Customer Success

Our analysis demonstrates that, as software companies grow, the most critical factor for valuation shifts from pure growth (often measured by ARR) to include the ability to generate free cash flow from ARR. In other words, having customers is not enough; you must monetize your customer base. This is where the “rule of 40” comes into play, where the sum of percentage growth and the free cash flow rate should equal 40 percent or higher.

Achieving strong free cash flow is largely about optimizing the payback period, which measures how long it takes to recover the customer acquisition costs. This entails efficient customer acquisition, customer retention, and upselling and cross-selling. It is quantified by the net retention rate (NRR), which demands a strong focus on customer success. Companies with high NRRs exhibit three common characteristics across sectors:

- They Know Their Numbers: Customer success relies on a data-driven understanding of how customers derive value from a specific product. Maximizing NRR entails analyzing various drivers of growth and churn at the customer level and implementing targeted interventions.

- They Establish a Dedicated Customer Success Function: A team capable of working closely with customers to extract maximum value from the product is particularly vital in AEC, where customers have lower digital maturity and less familiarity with established solutions. The largest AEC tech companies maintain customer success teams and organize conferences and training sessions for their users. For instance, one software company hired a retired construction contractor for its customer success function to better grasp customer needs.

- They Deliver Customer Success at Low Cost: Customer success does not always necessitate expensive dedicated customer support. It can often be achieved at a lower cost by cultivating user communities and encouraging the use of online tutorials, for example. One AEC tech company garnered thousands of users with minimal marketing spend by leveraging community forums and industry networks, effectively harnessing its own customers to promote the product.

Build Functional Maturity as You Scale

As software companies advance beyond the startup and scale-up stages, growth rates tend to slow, and operational efficiency becomes the key driver of free cash flow (and, by extension, valuation). This entails optimizing the net retention rate and marketing and sales expenditure, which can consume over 50 percent of the revenue of typical software companies. Software companies in the top quartile for valuation at scale typically exhibit the following characteristics:

- Optimize Marketing and Sales Spend: Leading software companies allocate marketing and sales expenditure to future revenue opportunities, providing extensive coverage for high-growth accounts. They continuously segment customers, concentrating on lower-potential customers through web sales, inside sales, while increasing expenditure on high-potential customers.

- Continuously Optimize Pricing and Track Impact: Leading players develop customer business cases that link pricing to the value generated for customers. They closely track the impact of pricing changes and adjust accordingly. Companies should also ensure their payment terms are appropriate. For instance, AEC tech players often price based on a project or milestone, which introduces significant risk due to project delays and dissuades potential investors.

- Leverage Data and Automate Processes: Successful software companies harness data, AI, and automated processes across their operations. They identify leads and proactively target cross-sell and upsell opportunities, use usage data in pricing and product decisions, and assess developer velocity.

- Strengthen the Business-Building Muscle: Tech companies of all sizes often reach a growth plateau without a market-ready product or offering to maintain momentum. Leading players continue to expand by launching new businesses more rapidly. They thoughtfully incubate new businesses, allocating dedicated resources for product development and go-to-market strategies.

In conclusion, the construction technology industry holds immense potential, but addressing the unique challenges it presents is crucial for achieving efficient growth. By embracing these strategies and characteristics, AEC tech companies can navigate the path to successful scaling and make a substantial impact on the construction industry.