Exploring Key Trends in the Construction Industry for 2023 – 2026

As per McKinsey’s insights, the construction industry, often referred to as the world’s largest, holds a significant share, contributing approximately 13% to the global GDP. Nonetheless, it has been one of the slower-growing sectors. The good news is that innovative construction technologies are on the horizon, aiming to expedite this transformation. In this article, we’ll delve into some of the pivotal trends shaping the construction industry.

1. The Ascension of Virtual Construction

Within the construction sector, we’re witnessing a growing embrace of various cutting-edge technologies. Many of these advancements revolve around virtual design and visualization. This spectrum encompasses Building Information Modeling (BIM) and Construction Management Software. Virtual design and construction (VDC) signify the increasing reliance on virtual environments to conceptualize and plan structures before they materialize in the physical realm. These virtual environments are accessible through desktop and mobile devices, as well as augmented and virtual reality hardware. The rationale behind this shift is clear: nearly 30% of construction industry expenses stem from rework necessitated by flawed or inaccurate builds. Virtual design mitigates this by enabling builders to construct and refine structures in a virtual realm. Among VDC tools, Building Information Modeling (BIM) stands out as a popular choice, allowing architects, engineers, and other stakeholders to generate a virtual model of a physical building or structure.

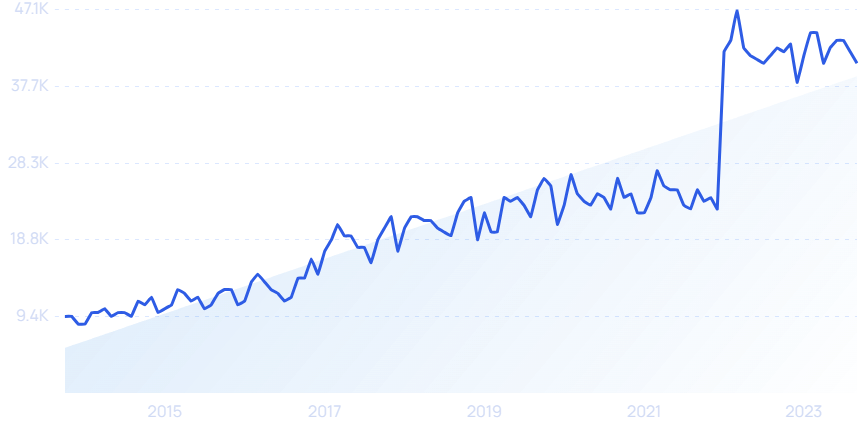

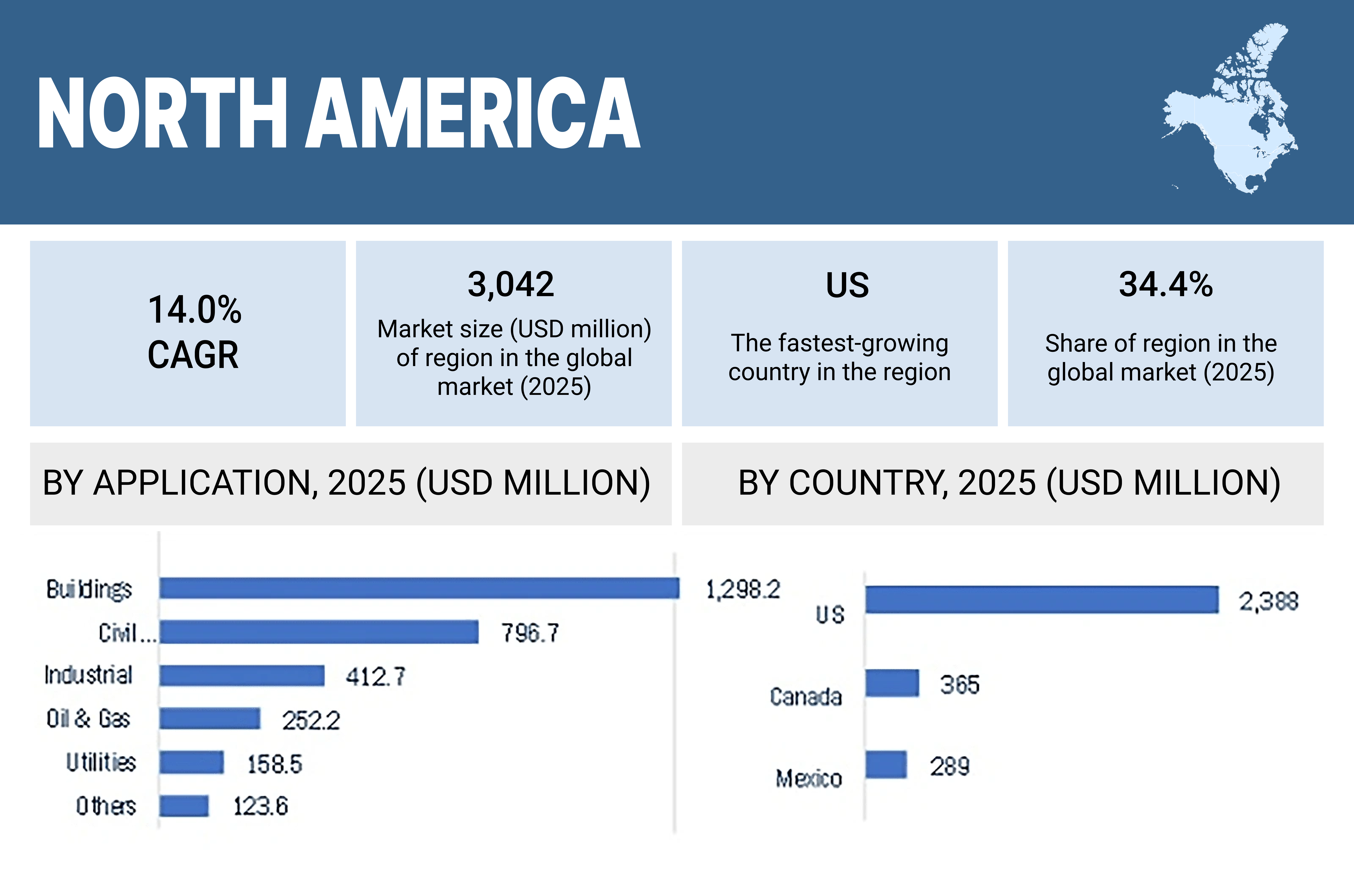

The BIM Market Outlook

As of 2023, the BIM market commands an estimated worth of approximately $8.1 billion. The construction sector did face some setbacks during the pandemic, but there are promising signs of recovery on the horizon over the next few years. North America is anticipated to lead this resurgence, capturing over 30% of the market share.

The Evolution of BIM Adoption

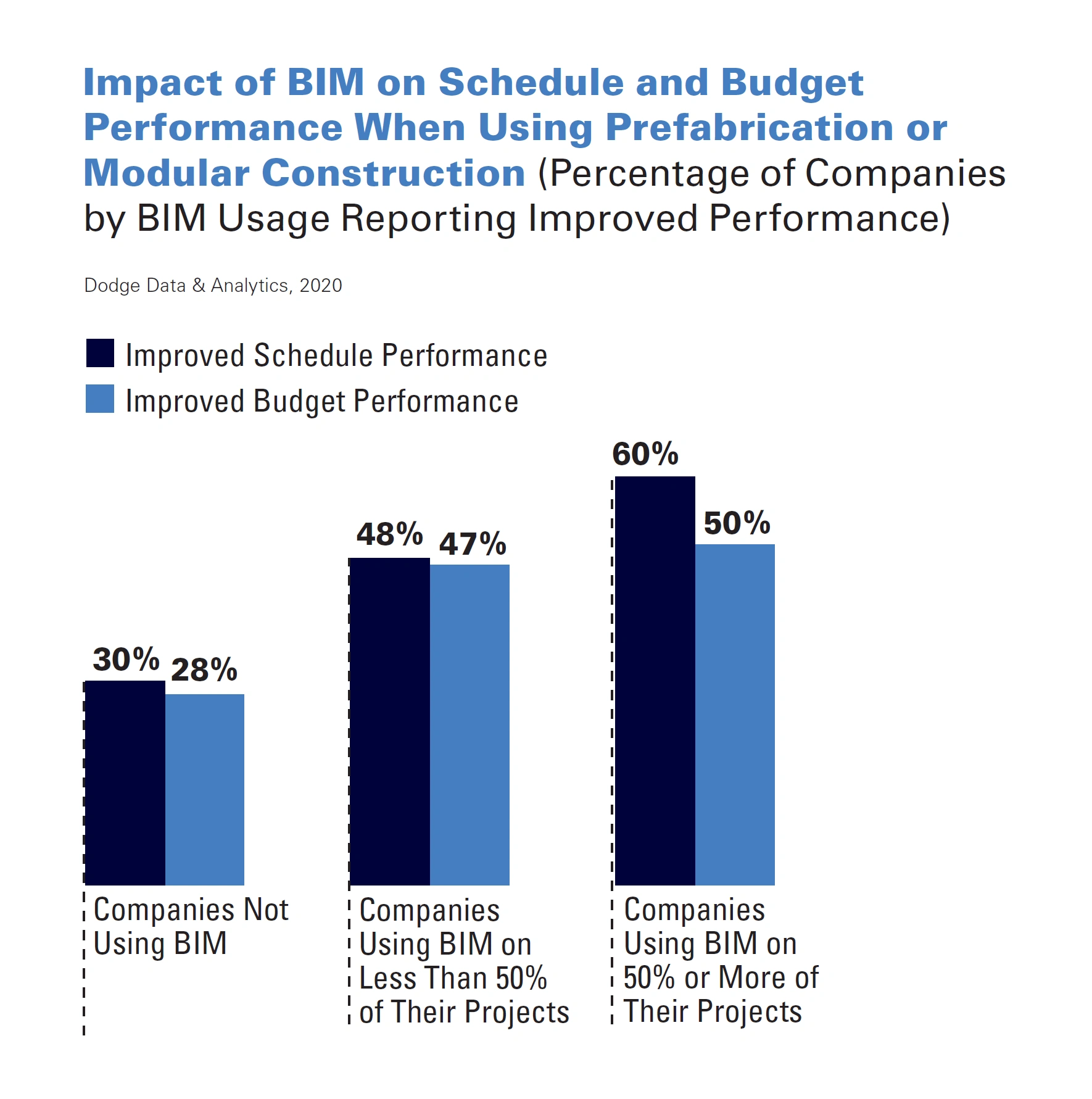

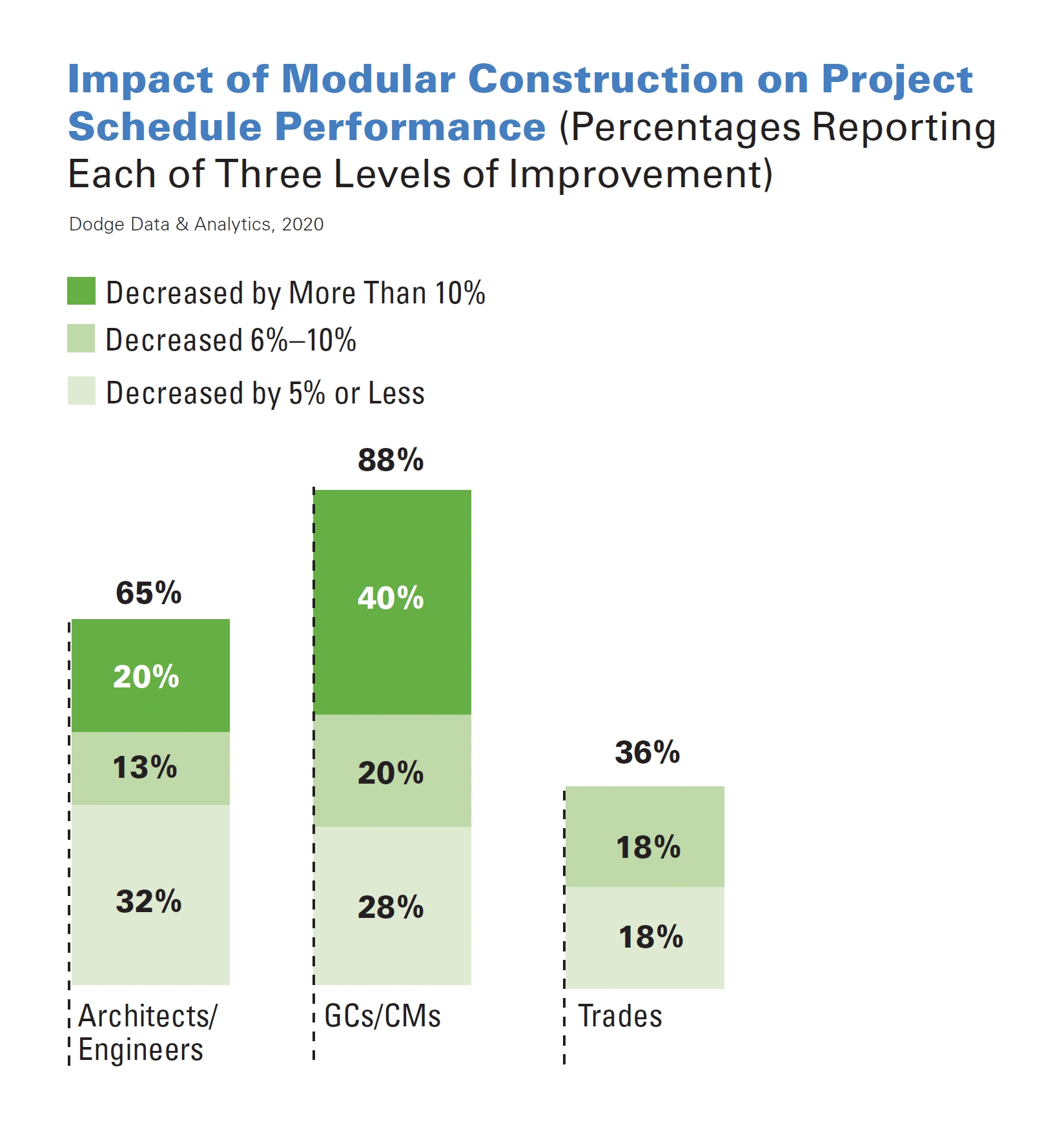

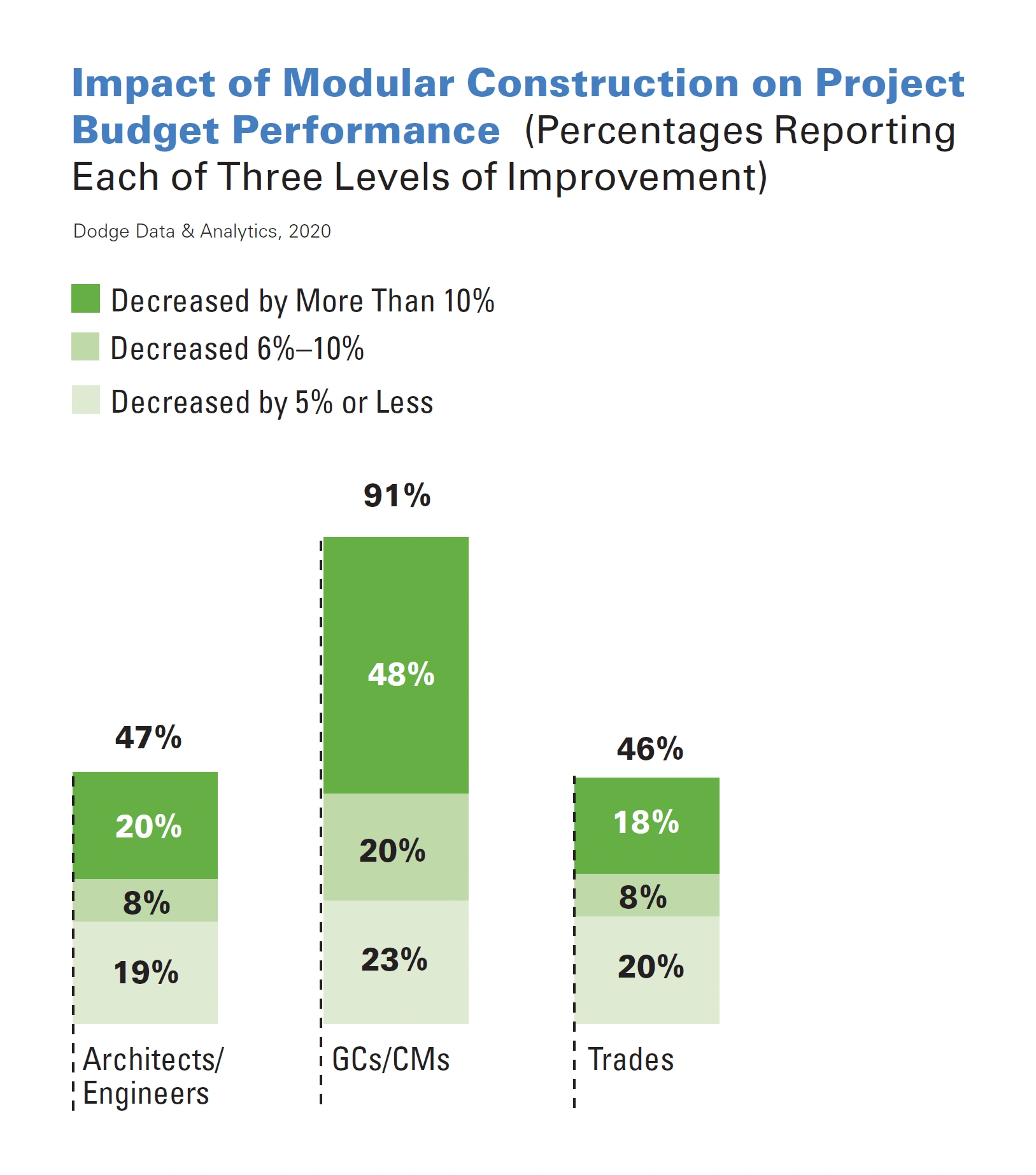

BIM technology has made significant strides, with an adoption rate now standing at around 60-70%. It’s worth noting that this adoption journey has been relatively gradual, spanning about 35 years. However, the past decade has brought optimism. In 2020, NBS’s BIM Report revealed that 73% of respondents had embraced BIM, marking a stark contrast to 2011 when almost half of them were unfamiliar with BIM. When combined with modular construction and prefabrication, BIM consistently aids construction firms in adhering to budgets and adhering to tight project timelines.

The Significance of Construction Management Software

Construction Management Software (CMS) has emerged as a pivotal tool for numerous major construction companies. Given the intricate and multifaceted nature of construction projects, which involve various stakeholders and concurrent activities, CMS plays a critical role by centralizing data, blueprints, and documents within a single accessible repository. The global construction management software industry is estimated at $9.3 billion and is projected to grow to $23.9 billion by 2031, boasting a CAGR of 10.2%. Autodesk takes center stage in the architecture and construction software market, with software solutions like AutoCAD, BIM 360, and REVIT setting industry standards. In fact, its traditional AutoCAD software holds sway over 85% of the market, with the company commanding an estimated 31% share of the overall market.

2. Prefab and Modular Construction Transforming the Landscape

Modular construction primarily entails the assembly of 60-90% of a building or structure off-site before transporting it to the construction site. Prefabrication, a component of modular construction, involves the manufacture or assembly of specific structure components off-site, simplifying their attachment to the building. As of 2022, the global modular construction market was valued at around $91 billion, projected to reach $120.4 billion by 2027. The modular construction sector has experienced remarkable growth in recent years, with McKinsey reporting a 51% increase in the North American permanent modular construction industry’s share of new projects between 2015 and 2018, accompanied by a doubling of total revenue. General contractors, architects, and developers are increasingly turning to prefabrication and modular construction for cost efficiency, streamlined schedules, and waste reduction. According to a 2020 report by Dodge, approximately 90% of respondents deemed these methods more advantageous than traditional construction.

Targeted Application of Prefabrication and Modular Construction

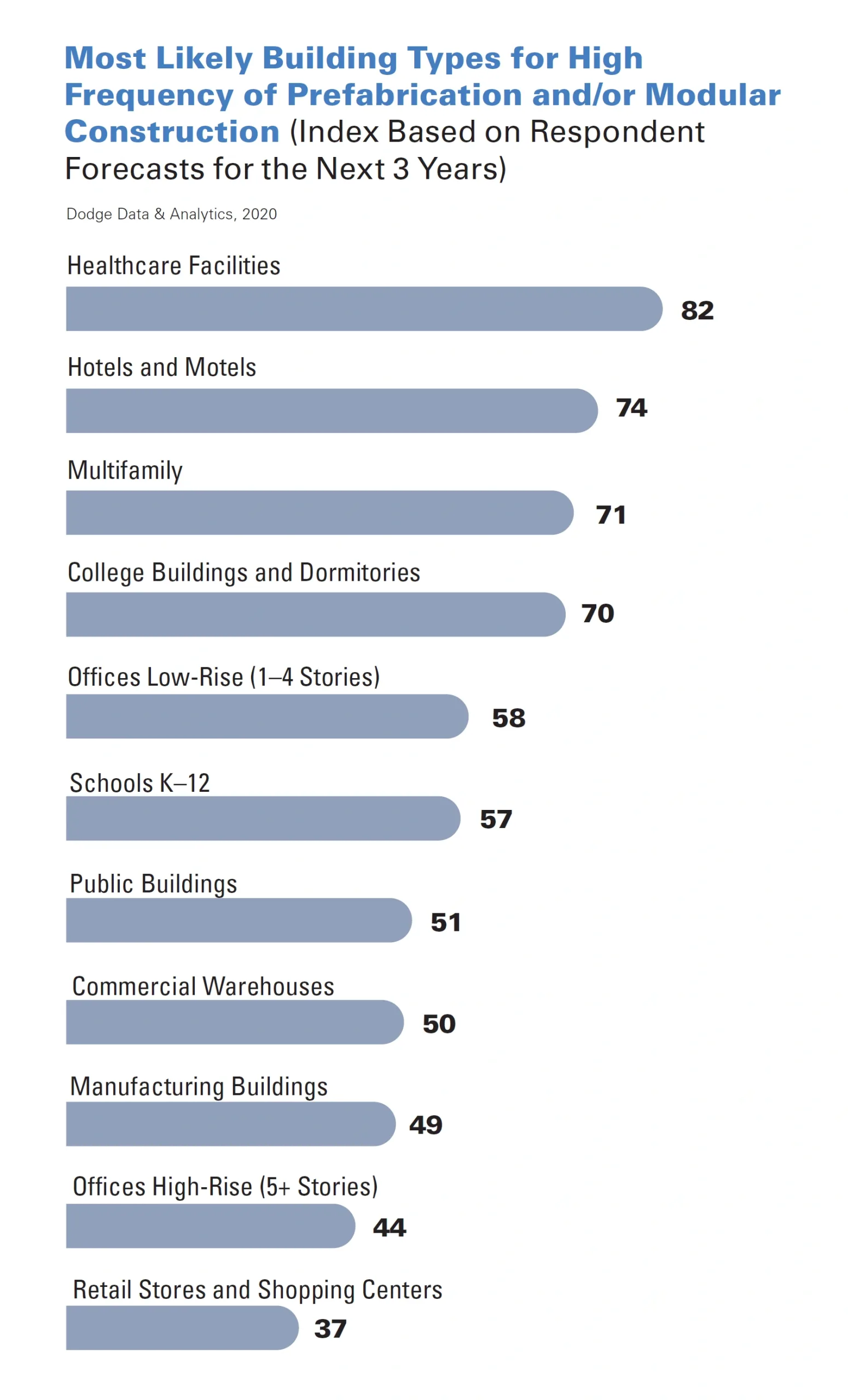

Certain types of structures are better suited to prefabrication and modular construction techniques. The healthcare sector appears poised to gain the most from these approaches in the coming years, according to findings by Dodge. Hotels, motels, and multifamily residential structures also stand to benefit significantly. Hotels and motels have notably emerged as leaders in embracing modular construction between 2018 and 2020, with roughly 43% of architects, engineers, and general contractors identifying them as the fastest-growing sector for modular construction during this period. The expanding modular construction market is also attracting new entrants, with Katerra being one of the most promising startups. Katerra’s focus is on comprehensive modularization of the construction process, fabricating specific building components in its facilities, allowing developers to assemble structures on-site, primarily targeting the residential real estate market. Despite recent challenges, Katerra recorded approximately $2 billion in revenue in 2020, buoyed by substantial funding, including $865 million from Softbank in 2018.

3. Embracing Green Building for Environmental Sustainability

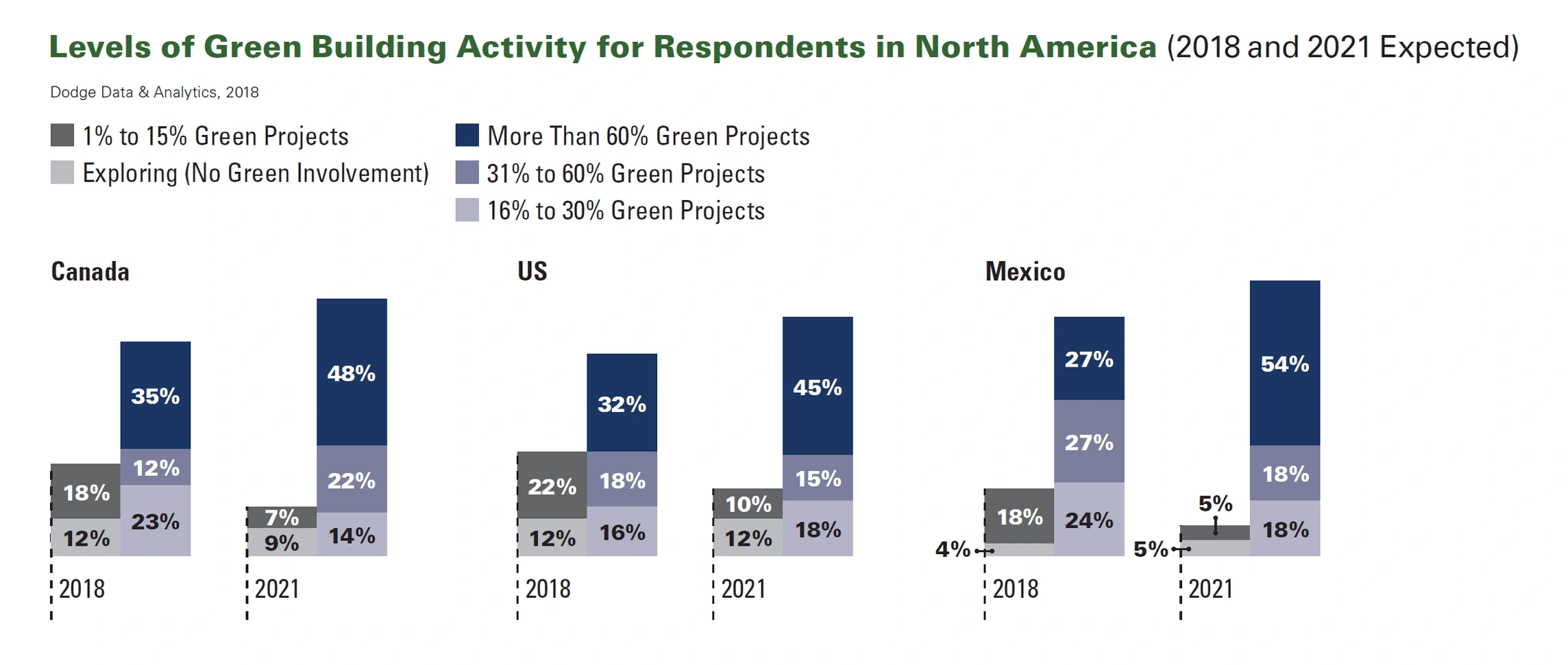

Green building principles involve constructing environmentally sustainable buildings through eco-conscious construction and design practices. As global governments and regulatory bodies prioritize environmental considerations across all industries, construction and design firms are increasingly adopting green building methods. According to Dodge’s World Green Building Report, nearly half of all construction and design professionals anticipate that the majority of their projects will align with green standards by the end of the year. McKinsey’s research indicates that 90% of construction industry stakeholders perceive a shift toward environmental sustainability as imminent. Notably, Canada has led the charge in North America, with the highest percentage of builders committed to green building practices, closely followed by the United States. Mexico is poised to lead the region, with over half of its builders anticipating the majority of their projects to adhere to green standards. The residential building sector, in particular, has witnessed substantial adoption of green building techniques. Over one-third of single-family and multi-family builders incorporate green building methods in at least half of their projects. Energy efficiency ranks as a top priority among green home builders, with 96% focusing on energy-efficient construction practices. This shift is driven by the realization that building operations contribute significantly to greenhouse gas emissions in the construction and real estate sectors. Consequently, over 90% of single-family residential builders incorporate energy-efficient practices in the construction of some or most of their buildings.

4. Challenges with Escalating Material Costs

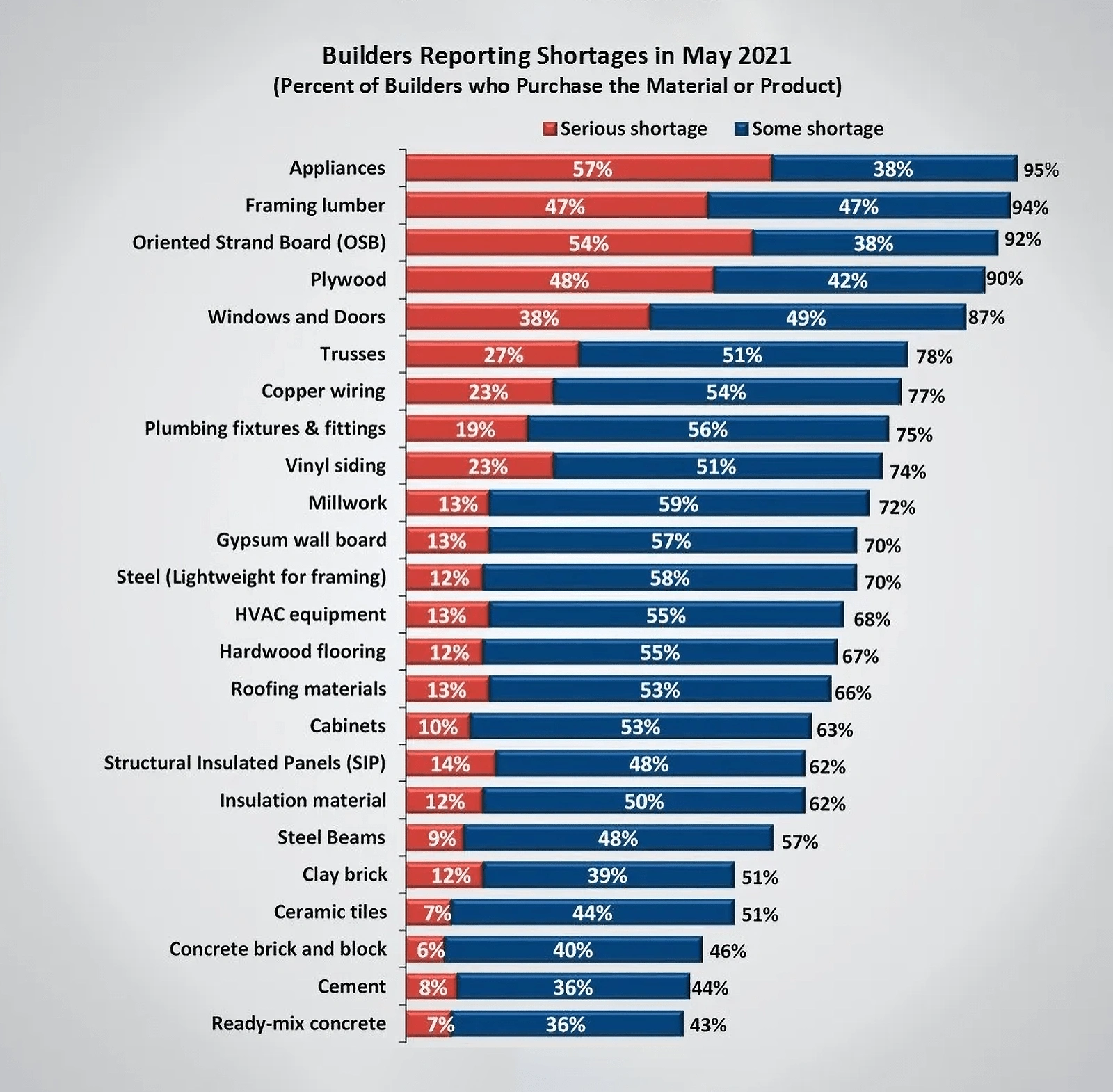

Many construction firms are grappling with the scarcity and soaring costs of specific materials. Over 90% of builders report encountering material shortages. A survey presented builders with a list of 24 materials and found that more than 70% of them faced shortages in at least half of these items. Notably, shortages were most pronounced for appliances, oriented strand board (OSB), and plywood. In June 2022, the Associated General Contractors of America unveiled data revealing a nearly 17% increase in construction material prices for nonresidential projects since June 2021. Diesel fuel witnessed the most substantial price hike, doubling since June 2021, followed by asphalt roofing products (up 22% year-over-year) and plastic construction products (up 27% year-over-year). The demand for aluminum has surged as well, with a 7.7% increase in 2021, followed by another 5.3% rise in the first quarter of 2022. As a result, aluminum prices have reached unprecedented levels, with industry experts estimating an average price per ton of $3,450 in 2022.

Steel, another critical construction material, faces scarcity and escalating costs. The Bureau of Labor Statistics Producer Price Index revealed a 123% year-over-year increase in the price of steel mill products in August 2021. Over the past decade, the average price for hot-rolled coil steel hovered around $400 per metric ton. However, executives in the industry project that steel prices will surge to $600 per metric ton in the coming years. More than one-third of contractors are grappling with a steel shortage.

These material shortages and price spikes are exerting immense pressure on construction firms and driving up their costs. Input costs have surged far more rapidly than the average bid prices construction companies quote for projects. In December 2021, the average input cost escalated by nearly 20%, whereas the average bid price only increased by 12.5%. A recent survey by Deloitte revealed that 20% of engineering and construction respondents anticipated a worsening of their operating profitability and industry margins.

Conclusion

That wraps up our exploration of the significant trends shaping the construction industry in the coming years. Overall, the twin themes of environmental sustainability and technology adoption emerge as common threads uniting many of these trends. Interestingly, these themes also translate into cost savings, potentially accelerating their adoption across the industry. As the construction sector continues to evolve, staying informed and adaptive is paramount for industry professionals and stakeholders alike.