The Changing Landscape of Procurement in the Construction Industry

In the evolving world of sustainable construction, Chief Procurement Officers (CPOs) are taking on pivotal roles to steer companies towards decarbonization and enhanced profitability. Despite being one of the world’s largest industries, construction typically operates on thin profit margins, with earnings before interest and taxes hovering around 5.0 percent. Productivity improvements have been sluggish, with an average growth rate of just 1.0 percent per year over the past two decades, compared to 2.8 percent for the overall economy. Recent disruptions, including the COVID-19 pandemic, the conflict in Ukraine, and a slowdown in new construction projects, have added to the pressure. As a response, construction companies are increasingly turning to procurement as a linchpin for improving profitability and maneuvering through uncertain times.

Furthermore, the construction sector has a pivotal role in achieving global sustainability objectives. The industry directly contributes to approximately 40 percent of CO2 emissions and indirectly accounts for 25 percent of all greenhouse-gas (GHG) emissions. The majority of these emissions fall under Scope 3, meaning they originate from suppliers or from the utilization and operation of the built environment.

In light of these challenges, optimizing procurement practices can expedite the construction industry’s efforts to reduce carbon emissions while serving as a source of competitive advantage in the future. This article elucidates how procurement can fulfill its dual mission of enhancing profitability and propelling decarbonization. It also offers recommendations for CPOs and other leaders throughout the value chain who wish to proactively shape the industry’s transition.

Unlocking Procurement Potential in Construction

Procurement occupies a significant position in the construction industry, typically accounting for 40 to 70 percent of a company’s total expenditures. Industry executives regard procurement as a trusted business partner. Recent research from McKinsey highlights the significant impact of the pandemic and the Ukrainian conflict on commodity prices and supply chains. This impact is already manifesting as rising global inflation rates. For instance, in 2022, most countries grappled with year-over-year inflation exceeding 5 percent. While the duration and repercussions of current inflation rates remain uncertain, they are bound to exert additional pressure on construction industry profitability.

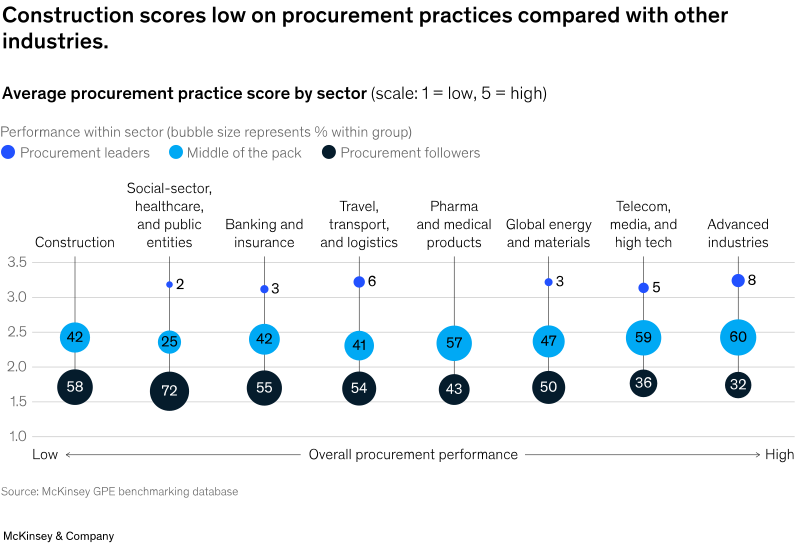

Despite the profound influence of procurement on margins, the construction industry lags behind other sectors in adopting best practices. This is partly due to external factors, including limited control over project specifications and intricate, fragmented supply chains, as well as internal challenges like decentralized project-specific mindsets.

Some construction companies have effectively surmounted these challenges by implementing group- or nationwide sourcing strategies that offer substantial savings potential. Those with top-tier procurement practices consistently bolster their financial performance, achieving margins that are sometimes five to ten percentage points higher than those of their procurement counterparts. Many CPOs in construction believe that consistently applying best-in-class procurement practices can yield savings of up to 12 percent for their companies.

The Dual Role of Procurement: A Strategic Phase for CPOs in Construction

In addition to its role in bolstering profitability during volatile and inflationary periods, procurement is poised to take on an even more significant role in decarbonizing construction. With 90 percent of emissions from construction companies falling under Scope 3 and procurement serving as the primary interface with the construction value chain, CPOs are positioned to lead the charge in reducing the CO2 footprint of construction projects. Engineers and architects can collaborate upstream by making changes in design, specifications, and materials procurement to complement downstream efforts. This elevation of the CPO’s role in construction companies, from a trusted business partner to a more strategic function, mirrors the trajectory seen in the automotive industry.

Immediate Actions to Strengthen Procurement’s Role

In the short term, there are several steps that procurement can take to play a pivotal role in the construction value chain:

- Establish Transparency for CO2 Footprint: Soon, managing CO2 targets will be as crucial as managing project budgets. However, standardized metrics for measuring emissions across the construction value chain are still lacking. Procurement experts will need to step up by developing comprehensive views of the entire life cycle and providing emission estimates for material sourcing from suppliers. This includes assessing the impact of sustainable versus non-sustainable materials or CO2 emissions from various sources.

- Gain In-Depth Insights into Materials and Suppliers: Understanding the cost and CO2 emissions differences among materials and suppliers is becoming increasingly important for procurement. Building a detailed view of the value chain involves looking at factors such as the material category, supplier, and individual assets, like energy sources, raw materials, production processes, and logistics. This level of insight enables informed sourcing decisions that incorporate sustainability into the procurement process effectively. Procurement experts can collaborate with suppliers to gather pertinent information, such as volume, composition, energy efficiency, and fuel consumption, and supplement their findings with expert research on emissions. Given today’s volatile environment, procurement teams can bolster their supply base resilience by refreshing category strategies and reevaluating the risk management model. This can be facilitated by a centralized control center, like a spending control tower or a live resilience dashboard.

- Facilitate Trade-Off Management: Procurement teams can work closely with engineering and project management units to make informed trade-offs, solidifying their position as thought partners rather than just a delivery function. Value engineering in construction will play an increasingly critical role as companies strive to standardize models and components, enhance design efficiency, and seek more cost-effective materials. Procurement teams must adapt the materials mix by prioritizing eco-friendly or low-emission solutions and equipping themselves as valuable advisors for value engineering in the trade-offs between design costs and CO2 emissions. For instance, a player in the oil and gas engineering, procurement, and construction sector developed a tool and cross-functional processes to assess how various suppliers or materials could impact the construction process and planning. This tool can help determine when “green products” will yield premiums compared to traditional solutions, which is important to 65 percent of developers and contractors.

Strategic Moves for the Long Haul

In the grand scheme of things, strategic levers for the construction industry will focus on securing access to eco-friendly materials. This means being proactive in anticipating where shortages of such materials may arise in the future and making long-term plans to ensure a stable supply. It goes beyond the current project pipeline and demands forward-thinking decision-making and demand forecasting.

Building stronger relationships with suppliers through supplier development, demand and capacity planning, and supporting their efforts to reduce carbon emissions will remain crucial. However, it may not be enough to address the potential scarcity of certain materials. In such cases, construction companies might need to consider investing in, acquiring, or even establishing new suppliers, mirroring what the automotive industry did when it invested in green-steel start-ups in Europe and the United States.

Construction companies that can develop and demonstrate expertise and capabilities in this regard can become leaders in the green transition. This, in turn, positions them as attractive partners for developers and project owners. Achieving this, however, necessitates procurement teams to act on three key fronts:

- Talent and Expertise: Decarbonizing the construction of a building or structure is a complex endeavor, with a multitude of decisions and alternatives. Leading construction companies must, therefore, focus on building, training, and attracting new expertise. To be valuable partners to forward-thinking project owners, developers, and other stakeholders, these companies need experts who can guide and recommend trade-offs between materials and technologies, assess design simplifications against their impact on function and value, and evaluate risks and unproven approaches. These new roles should not only be part of the procurement organization but also closely integrated with engineering, design functions, and project teams.

- Roles and Mandates: To fully leverage this expertise in meeting sustainability targets, construction companies should revisit roles and mandates. CPOs and procurement leaders should engage early in projects, even during the tendering phase, and play crucial roles as decision makers in material and supplier selection. This involves providing specific recommendations or alternatives to optimize the balance between profitability and sustainability, tailored to each category and project. It also involves securing access to scarce resources through strategies such as mergers and acquisitions.

- Data and Market Intelligence: As mentioned earlier, procurement teams will need a more detailed view of materials and suppliers, which requires access to additional data and the right tools and dashboards to support decision-making. In the coming years, the construction and building materials industry is expected to rapidly advance in production processes, alternative materials, new technologies, and decarbonization methods. During this time, data may not always be readily available. To make informed decisions and secure certifications, procurement teams may need to gather reliable information and data on alternatives. This might involve building databases, conducting research, and even conducting tests. Teams can also utilize available information like environmental product declarations and life cycle assessments. However, this information should be supplemented with highly detailed data gathered in collaboration with suppliers, such as the CO2 footprints of specific materials or the specifics of production batches, including the manufacturer, plant, production line, and energy sources used. Regarding new digital tools, teams can use dashboards similar to those used for managing customer relationships to collect, display, and interpret data ranging from emissions at the asset level to logistics costs and emissions, and use this data to make trade-off decisions that align with each project’s defined targets.

Conclusion

As the main interface with the construction value chain, the procurement function is facing a dual mission of enhancing profitability in an unpredictable environment while striving to meet sustainability goals. By doing so, procurement is poised to evolve into a strategic function. Chief Procurement Officers (CPOs) who take action now can position their companies at the forefront of the sustainability transition, making them attractive partners for leading developers in the future.